So, what’s covered in this month’s newsletter:

- Market Update

- My Trade Update

- Adventures of a Trader Webinar Recording

If you have recently subscribed to my website, or for some reason you did not receive my last newsletter email, you can view the previous newsletters from this web link:

http://smarttrading.com.au/wp/news/

| Market Update |

The markets have had a great run back up to their resistance area and I have been enjoying the ride with my trading systems. Of late gold and oil stocks have been dominating the scans. When these commodities are running, the shares in this industry also run and show up with signals in my scans. So while I don’t trade the underlying commodity I do trade shares related to the commodity so I invest in this way through the equities market with shares and CFDs. I have two trades to share with you that are from the utility and gold sectors, so read on.

You can see the current trends of the Aussie and US markets through the charts of the ASX200 and S&P 500 below.

Weekly Chart of ASX 200 Chart as at 8 June 2016

Below is a weekly chart of the ASX 200. It has had a great run back up since mid April and broke through its downtrend line and is now teetering around a key resistance area. Does it have the power to push through in the coming week? There’s no way to predict what will pan out next. I just take the signals the market is giving me at the time and follow my trading plan rules.

(Click on the image to view a larger version)

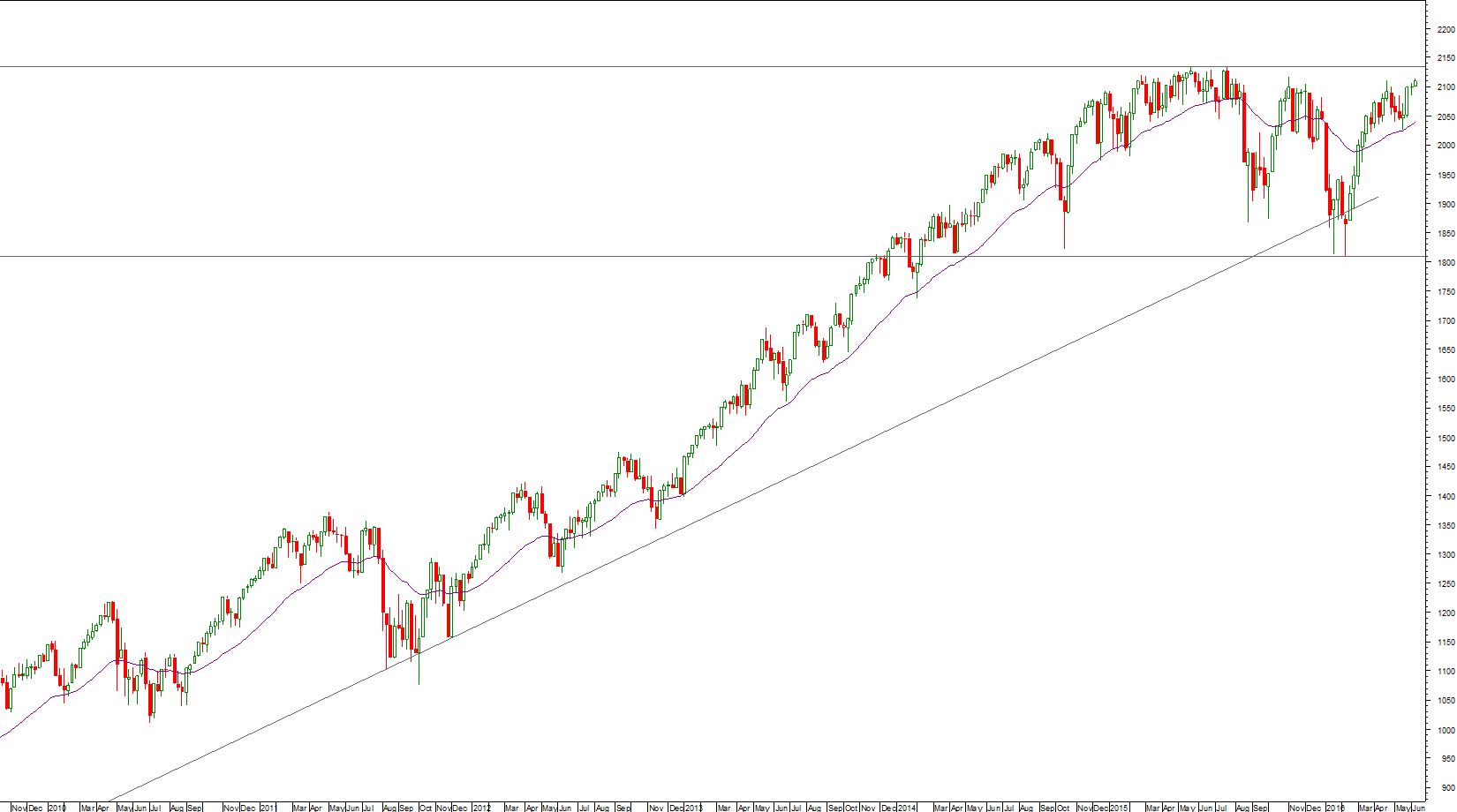

Weekly Chart of S&P 500 Chart as at 7 June 2016

Below is a weekly chart of the US S&P500. It has also had a strong rise. Will we see some new highs and can it manage to push through resistance? With the upcoming major elections causing uncertainty, it might continue to stall or not. Only time can tell what the markets will do and I love watching patterns unfold in the charts.

(Click on the image to view a larger version)

| Trade Update |

Here’s an update on my trade that I shared last newsletter. This share is from the utilities sector and this trade is a big winner for me and is still open and running. The chart shows many small blue arrows, which are the days my system generated an entry signal and would have appeared in my daily market scan that day. The blue line is my trailing stop loss indicator that I kick in once I open a trade – this is when money management becomes the most important.

I entered a CFD trade into this share on 14 March at 56c when it came up in the daily market scan and met my trading rules. It has since doubled in price and I am now in a nice position of utilising my windfall profit strategy.

(Click on the image to view a larger version)

Below is a gold stock I am currently trading. Once again this one came up in my daily market scan on 26 May and met my trading rules, so I entered into it with a CFD trade and have my trailing stop loss running underneath. The share has since burst through $1 mark with a huge gap and a nice white candle. That day a lot of gold stocks came up in my scans all giving very similar signals.

(Click on the image to view a larger version)

I have covered more of my trades comprehensively in the monthly market update video I produce for my exclusive Smart Traders Mastermind group. You too can become a Mastermind member when you join my Mentor Course.

If you take my Ultimate Smart Trading Mentor Course, the extra special bonus is becoming a part of my exclusive Smart Traders Mastermind Program where you receive monthly video market updates, an invitation to several webinars throughout the year and access to a private discussion forum so you can connect with a community of traders that have all been through the course.

The course includes 15 webinar videos that I personally recorded, downloadable audios from each webinar, comprehensive course notes and additional practical short videos showing how to put what you have just learnt into practice.

Check it out and see if it’s a good fit for you – Ultimate Smart Trading Mentor Course.

| Adventures of a Trader Webinar Recording |

My webinar Adventures as a Trader on 23 & 24 May was a huge success. The number of attendees on the evening event surpassed GoToWebinar’s limit and not everybody could make it online for the live event. If you missed the event or you want to watch it again, the recording is online now until 30 June.

During the webinar, I discussed how I have developed a trading system to trade all market conditions, which is streamlined to fit my lifestyle and only takes 15 minutes of my time per day.

I’ve also featured what I do during my trading time each day. Including how I run a daily market scan, review the shares in the report and select a trade based on my trading rules. Then, I also showcased how I position size the trade according to my risk strategy and place the trade in the market with a stop loss linked to it. I also tackled other trading actions I take and feature some of my current trades. All in a day of a trader plus more adventures.

To watch the webinar, click on the link below:

http://smarttrading.com.au/wp/adventures-of-a-trader-webinar-23-may-2016/

| Finally |

We can’t predict what the market is going to do. The only thing we can do is to take the signals the market is going to give us and see if it lines up with our trading plan rules.

So, how do you know you are getting the right signal? And what rules do you have in your trading plan? These are the things we can take control of. We can prepare for it, educate ourselves and learn or we can trade blindly and lose big time. Take your pick.

I look forward to sharing more with you.

Cheerio for now

Justine Pollard

Author, Private Trader & Trading Mentor

‘Discover the Smarter way to trade’

www.smarttrading.com.au

justine@smarttrading.com.au

Smart Trading Pty Ltd is a Corporate Authorised Representative, AR No.336312 of Finsa Pty Ltd AFSL 422661

Any returns reported are provided for information purposes only and results of past performance are no guarantee of future returns. No assurance is given that you will incur any profits or losses in your own trading and it should not be assumed that you will experience results comparable to those as reported. Any trade examples listed within this email or associated material are either fictitious or historical and in no way should be interpreted as a recommendation to invest in any particular stock, CFD or investment.

This email and any attachments are also subject to copyright. No part of them may be reproduced, adapted or transmitted without the prior written permission of Smart Trading Pty Ltd.

Consult your financial advisor prior to any form of investment as information provided within this email is general by nature and doesn’t take into account your objectives, financial situation or needs. The risk of loss in trading can be substantial therefore you should carefully consider whether such trading is suitable for you in light of your personal and financial situation.

Smart Trading Pty Ltd as Authorised Representative No.336312 of Finsa Pty Ltd AFSL 422661 assumes no responsibility for your trading and investment decisions or subsequent results.